Blog

- Home

- Blog

Our Blog

Tax & Compliance Updates

Get quick updates on recent changes in tax laws and compliance regulations that matter to you.

Startup Tip Every Founder Must Know in FY 2026 – A Compliance & Tax Guide for Indian Startups

Startup Tip Every Founder Must Know in FY 2026 – A Compliance...

India–EU Free Trade Agreement 2026: Complete Tax, GST, Customs & Compliance Strategy for Indian Businesses

Introduction: Why the India–EU Flogan is a Turning Point for Indian Industry...

Union Budget 2026: Comprehensive Income Tax and GST Impact Analysis for Taxpayers and Businesses Across India

The Union Budget 2026, presented on 1 February 2026 by Nirmala Sitharaman,...

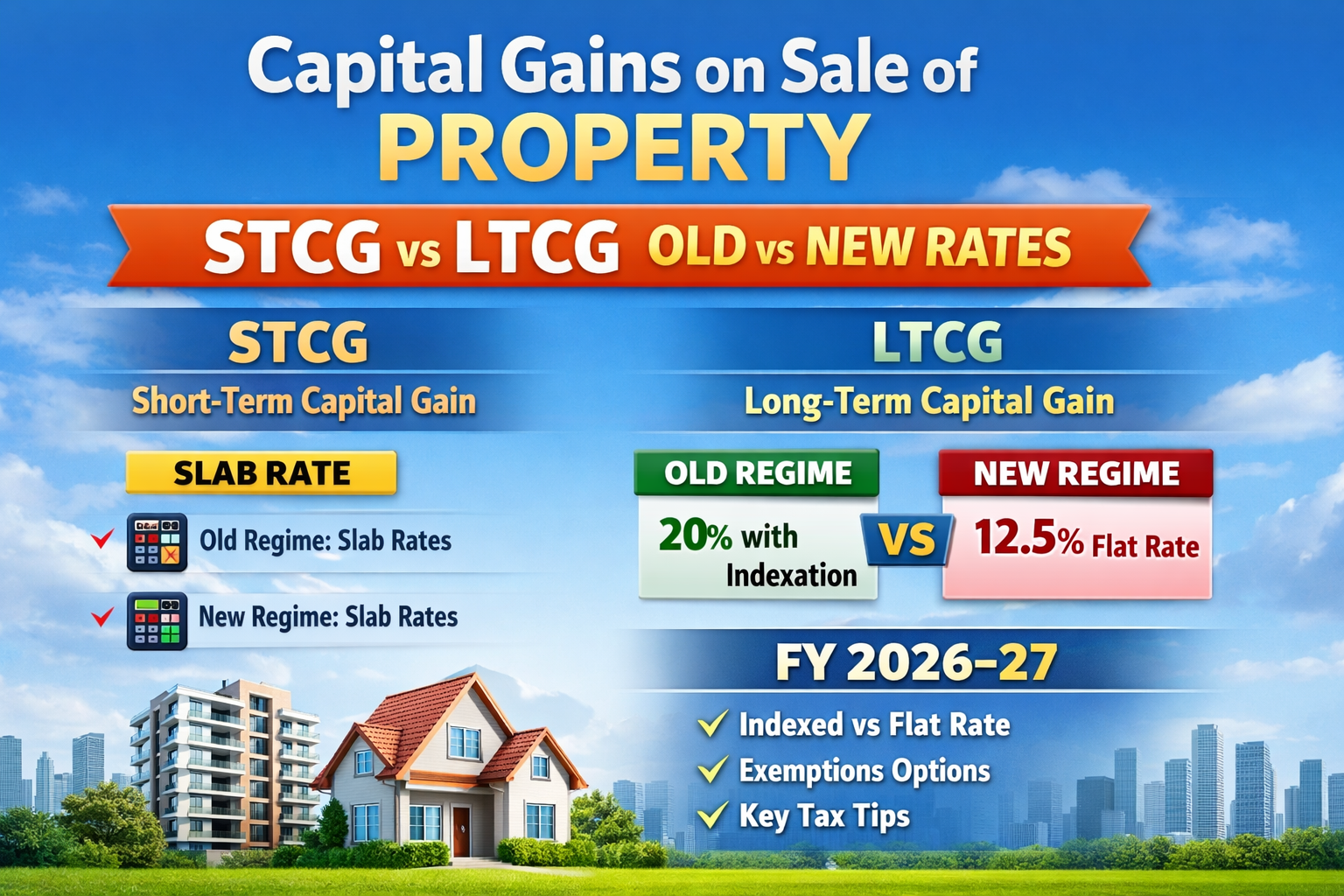

Capital Gains on Sale of Property – STCG & LTCG (Old vs New Rates) Complete Guide for FY 2026–27 (AY 2027–28)

Capital gains arising from the sale of immovable property are a major...

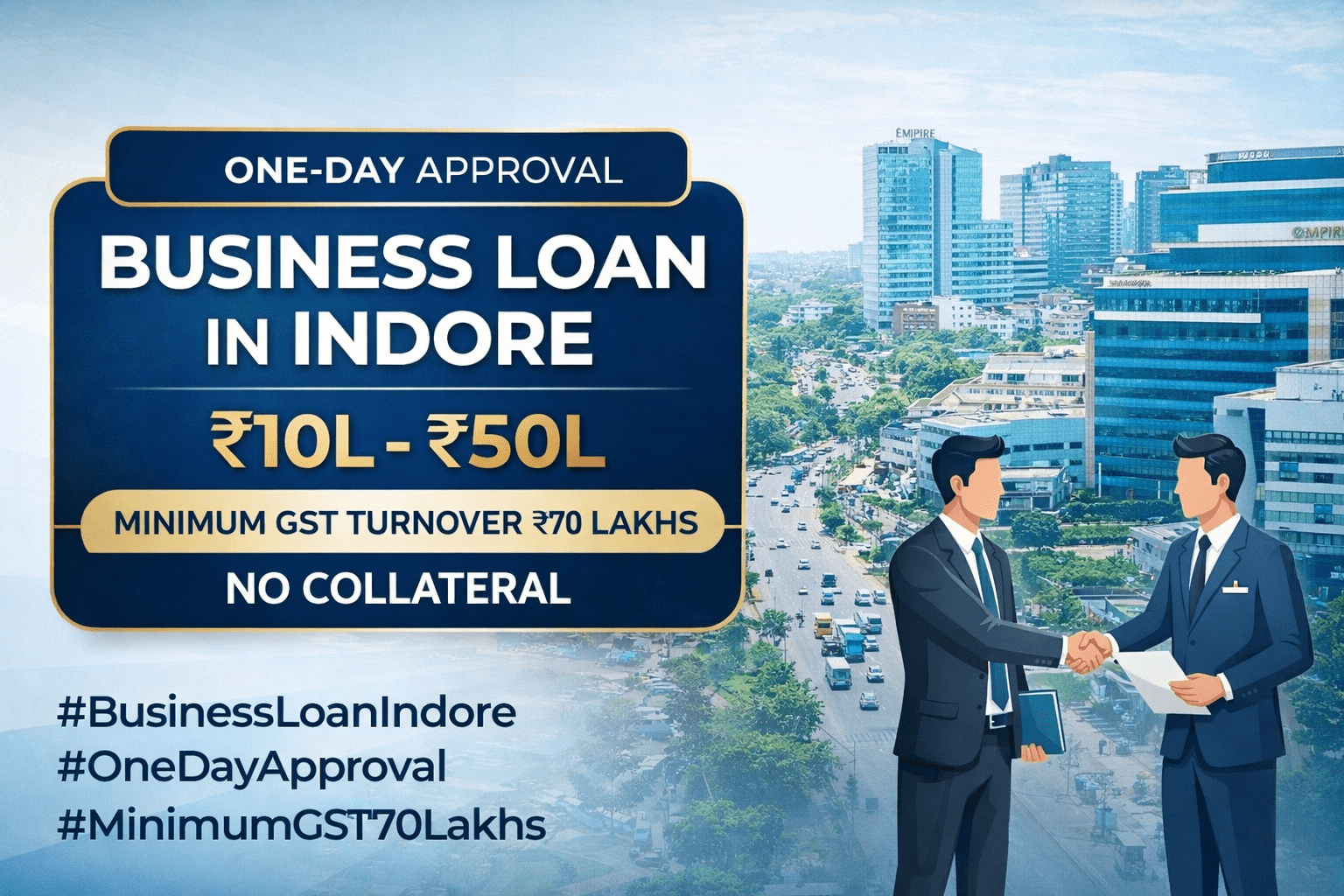

One-Day Approval Business Loan in Indore (₹10L–₹50L)

One-Day Approval Business Loan in Indore (₹10L–₹50L) Minimum GST Turnover ₹70 Lakhs...

How Much Cash Can You Keep at Home in India? Income Tax Law Explained (2026)

How Much Cash Can You Keep at Home in India? Income Tax...

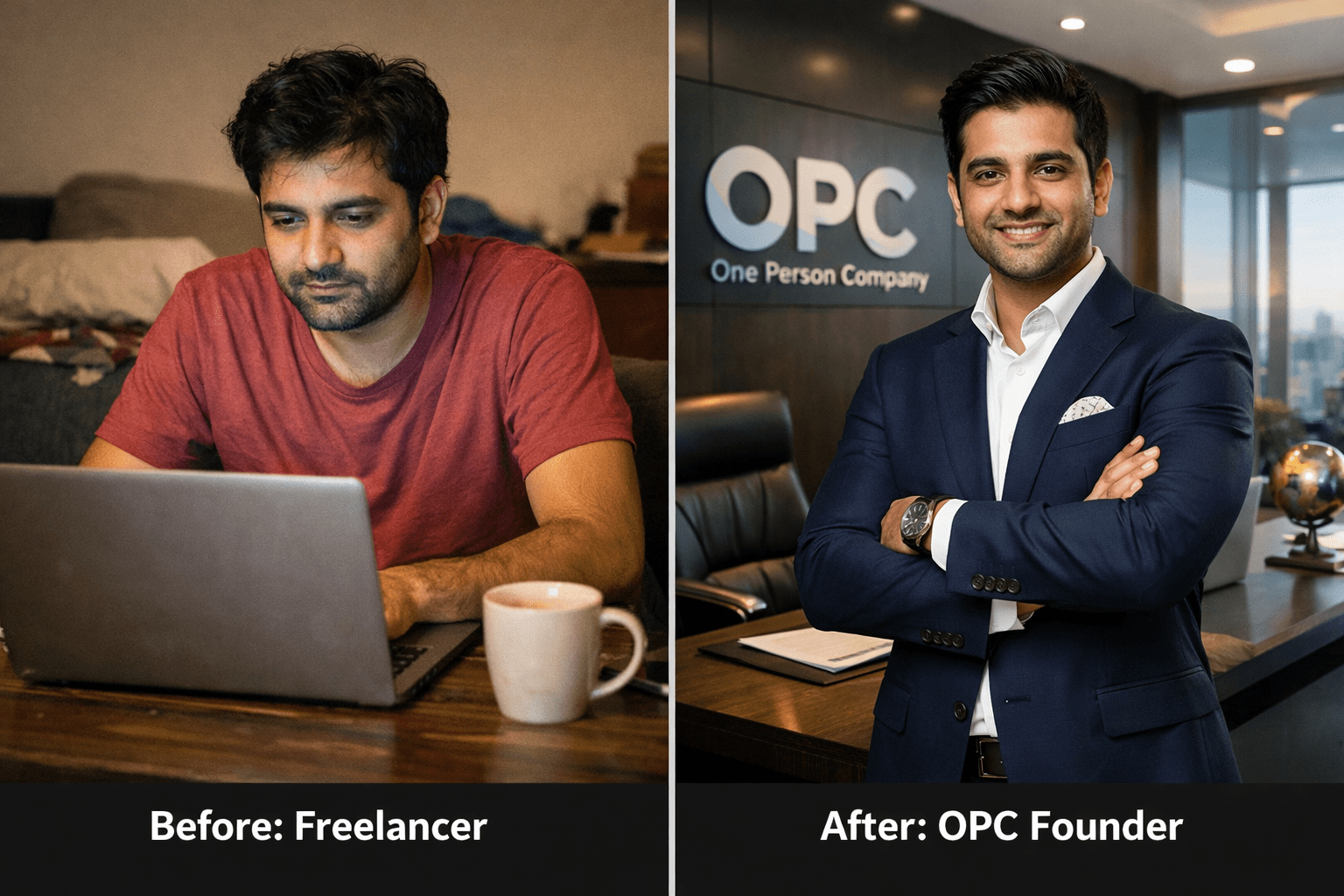

From Freelancer to OPC: Why 2026 is the Year to Exit Personal Taxation

In 2026, the Indian "Gig Economy" has matured into a "Consultant Economy."...

Latest Official Amendments – Director KYC & ADT-1 Compliance (2026)

Major MCA Amendment to Director KYC Rules (Effective 31 March 2026) The...

6 New GST Compliance Rules Effective 1 January 2026 — Impact, Actions & Checklist

6 New GST Compliance Rules Effective 1 January 2026 — Impact, Actions...

GST Registration Cancelled? How to Restore GSTIN Legally in India (2025 Ultimate Compliance & Litigation Guide)

GST Registration Cancelled? How to Restore GSTIN Legally in India (2025 Ultimate...

Pvt Ltd vs. LLP in 2026: The Strategic Architect’s Guide to Entity Selection

Choosing between a Private Limited (Pvt Ltd) Company and a Limited Liability...

New vs. Old Tax Regime 2026: A Comprehensive Guide for AY 2026-27

As we enter the first full assessment cycle under the Income Tax Act...

Income Tax Notice for Bogus Deductions Claimed by Consultant or Intermediary? A Complete PAN-India Guide for Taxpayers

Income Tax Notice for Bogus Deductions Claimed by Consultant or Intermediary? A...

Income Tax Slabs, ₹12 Lakh Rebate & Exclusions of Special-Rate Incomes (FY 2025-26 / AY 2026-27) Comprehensive Guide for Indian Taxpayers, Investors & Professionals

Introduction The Union Budget 2025 introduced significant reforms in personal taxation that...

Why Silver Is the Hottest Investment of 2025 — Complete Expert Analysis & Best Investment Strategy

Silver has become the most talked-about investment theme of 2025. Prices have...

GSTR-9 & GSTR-9C Filing for FY 2024-25 – A Comprehensive Professional Guide

Introduction The filing of GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement and...

TDS Compliance in India 2025: A Complete Expert Guide for Businesses, Startups, MSMEs & Corporates Across the Country

TDS Compliance in India 2025: A Complete Expert Guide for Businesses, Startups,...

Why Income-Tax Refunds Are Getting Delayed . How You Can Track or Expedite Them (Post-2025)

Why Income-Tax Refunds Are Getting Delayed & How You Can Track or...

What Happens If You Do Not File Your Income Tax Return Even After the Belated or Revised Due Date?

What Happens If You Do Not File Your Income Tax Return Even...

💼 NRE vs NRO Account – Key Differences Explained (2025 Guide for NRIs)

💼 NRE vs NRO Account – Key Differences Explained (2025 Guide for...

Income Taxability of NRI (Non-Resident Indian)

🌍 Income Taxability of NRI (Non-Resident Indian) – Complete Guide (2025) Author:...

🧾 GST Registration Process in Indore(MP) – Step by Step (2025 Guide)

Author: CA Pankaj AgrawalFirm: M/s Pankaj Agrawal & Associates, Chartered AccountantsLocation: Indore,...

1. The New Income Tax Framework, Income tax act 2025 – A Big Shift (Effective FY 2025-26)

1. The New Income Tax Framework – A Big Shift (Effective FY...

GST Changes 2025: New GST Slabs & Exemptions Effective 22 September | Impact on Indian Businesses

🌐 GST 2.0: A Landmark Reform for Indian Businesses From 22 September...

Income Tax Refund Time Limit in India | CA in Indore

Income Tax Refund Time Limit in India | CA in Indore (Know...

GST Registration & Audit Requirements for Freelancers in India

Introduction The freelancing economy in India is booming — from content creators...

Proprietorship vs OPC vs Pvt Ltd vs Partnership vs LLP | Business Structure Guide India

Introduction Starting a business is exciting, but one of the first (and...

Impact of U.S. Tariffs on India 2025

Introduction: The New Tariff Shock of 2025 Global trade is once again...

Tax Audit in Madhya Pradesh- Section 44AB Guide | CA Pankaj Agrawal

Tax Audit in Madhya Pradesh — Complete Guide (Section 44AB) Author: CA...

Chartered Accountant Services in Indore & Across Madhya Pradesh — Your Trusted Compliance & Growth Partner

Expert CA services in Indore, Pithampur, Ujjain, Dewas, Mandsaur, Neemuch & Ratlam....