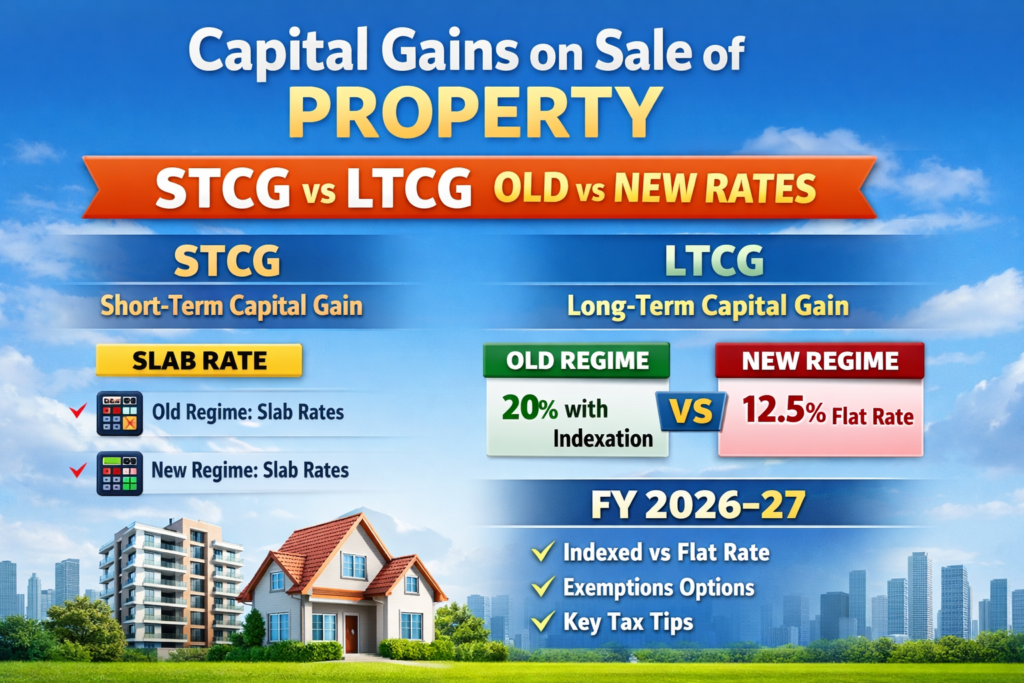

Capital gains arising from the sale of immovable property are a major area of taxation under the Income-tax Act, 1961. For FY 2026–27, taxpayers must carefully distinguish between Short-Term Capital Gain (STCG) and Long-Term Capital Gain (LTCG), as well as understand the old and new tax rate structure, especially after the introduction of the optional new LTCG rate of 12.5%.

This article explains the provisions in a practical, updated, and compliance-oriented manner.

1. Holding Period for Property

For land, building, or house property:

-

Holding period up to 24 months → Short-Term Capital Asset

-

Holding period more than 24 months → Long-Term Capital Asset

The 24-month threshold remains unchanged for FY 2026–27.

2. Short-Term Capital Gain (STCG) on Property

2.1 When STCG Arises

STCG arises when a property is sold within 24 months from the date of acquisition.

2.2 Computation of STCG

STCG =

Sale Consideration

(–) Cost of Acquisition

(–) Cost of Improvement

(–) Transfer Expenses

Indexation benefit is not available.

2.3 STCG Tax Rate – Old vs New Regime

There is no difference in the tax rate of STCG under the old tax regime and the new tax regime.

-

STCG on property is added to total income

-

Taxed at normal slab rates

-

Plus surcharge (if applicable)

-

Plus 4% Health & Education Cess

There is no concessional or flat rate for STCG on immovable property under either regime.

2.4 STCG Example

Purchase price (FY 2025–26): ₹55,00,000

Sale price (FY 2026–27): ₹75,00,000

Transfer expenses: ₹1,00,000

STCG = ₹19,00,000

Taxable at applicable slab rate (same under old and new regime).

3. Long-Term Capital Gain (LTCG) on Property

LTCG arises when the property is sold after being held for more than 24 months.

For FY 2026–27, two alternative tax regimes are available for LTCG on property.

4. OLD LTCG REGIME (With Indexation)

4.1 Computation

LTCG =

Sale Consideration

(–) Indexed Cost of Acquisition

(–) Indexed Cost of Improvement

(–) Transfer Expenses

Indexation is done using the Cost Inflation Index (CII) notified by the CBDT.

4.2 Tax Rate – Old Regime

-

20% with indexation

-

Plus surcharge (if applicable)

-

Plus 4% Health & Education Cess

This regime is generally beneficial for properties acquired long ago.

5. NEW LTCG REGIME (Optional – New Rule)

5.1 Applicability

The new LTCG regime applies to:

-

Land or building or both

-

Acquired before 23 July 2024

For such properties, the assessee can choose either the old regime or the new regime.

5.2 Computation (Without Indexation)

LTCG =

Sale Consideration

(–) Actual Cost of Acquisition

(–) Actual Cost of Improvement

(–) Transfer Expenses

Indexation benefit is not allowed.

5.3 Tax Rate – New Regime

-

12.5% (flat rate)

-

Plus surcharge (if applicable)

-

Plus 4% Health & Education Cess

6. STCG vs LTCG – Rate Comparison Summary

STCG

-

Holding period: Up to 24 months

-

Indexation: Not available

-

Tax rate: Normal slab rate

-

Old vs new regime: No difference

LTCG – Old Regime

-

Holding period: More than 24 months

-

Indexation: Available

-

Tax rate: 20%

-

Regime choice: Optional

LTCG – New Regime

-

Holding period: More than 24 months

-

Indexation: Not available

-

Tax rate: 12.5%

-

Regime choice: Optional

7. LTCG Comparative Illustration

Purchase price (FY 2012–13): ₹35,00,000

Sale price (FY 2026–27): ₹1,10,00,000

Indexed cost (assumed): ₹70,00,000

Old Regime:

LTCG = ₹40,00,000

Tax @20% = ₹8,00,000 (+ cess)

New Regime:

LTCG = ₹75,00,000

Tax @12.5% = ₹9,37,500 (+ cess)

In this case, the old regime is more beneficial due to indexation.

8. Exemptions on LTCG (Available Under Both Regimes)

The choice of tax rate does not affect exemptions:

-

Section 54 – Sale of residential house

-

Section 54F – Sale of any long-term capital asset

-

Section 54EC – Investment in notified capital gain bonds (limit ₹50 lakh)

All conditions and timelines must be strictly complied with.

9. Section 50C – Stamp Duty Value

If stamp duty value exceeds actual sale consideration, the higher value may be adopted as deemed consideration for capital gain computation, subject to permissible safe harbour limits.

This is a high-risk scrutiny area.

10. TDS on Sale of Property – Section 194-IA

-

Buyer deducts TDS @1% if consideration exceeds ₹50 lakh

-

Applies to both STCG and LTCG

-

Compliance through Form 26QB

11. Key Takeaways for FY 2026–27

-

STCG on property is always taxed at slab rates

-

No old vs new regime difference for STCG

-

LTCG now has two alternative tax rates: 20% with indexation or 12.5% without indexation

-

Indexation vs lower rate comparison is essential

-

Exemptions under Sections 54, 54F, and 54EC continue

-

Transaction-wise computation is critical for correct tax planning

12. Professional Conclusion

The introduction of the optional 12.5% LTCG rate represents a shift towards rate-based taxation, but it does not eliminate the relevance of indexation. For older properties, the traditional 20% indexed regime often remains more tax-efficient, while for recent acquisitions, the new regime may reduce tax outflow.

STCG, however, remains completely unaffected by regime selection and continues to be taxed at normal slab rates.

Regards

CA. Pankaj Agrrawal

7999028234