TDS Compliance in India 2025: A Complete Expert Guide for Businesses, Startups, MSMEs & Corporates Across the Country

As India adopts deeper digitization and AI-driven tax enforcement, Tax Deducted at Source (TDS) has become one of the most critical compliance functions for organisations nationwide. Whether you operate a startup in Bengaluru, a manufacturing unit in Pune, a trading company in Indore, an IT firm in Hyderabad, a logistics business in Delhi, or a consultancy in Mumbai, the quality of your TDS compliance directly affects:

-

Your audit outcomes

-

Your financial credibility

-

Your risk of receiving tax notices

-

Your ability to claim expenses

-

Your litigation exposure

The Income Tax Department now uses advanced systems such as AIS/TIS, Form 26AS, TRACES analytics, and intelligent cross-matching algorithms to detect even minor TDS discrepancies. This makes professional-grade TDS management not optional, but essential.

1. Why TDS Has Become a High-Risk Compliance Area for Every Indian Business in 2025

In recent years, the Government has strengthened mechanisms to detect:

-

Short deduction

-

Non-deduction despite threshold breach

-

Rate misapplication

-

PAN errors resulting in 20% TDS

-

Late deposit interest under 201(1A)

-

AIS vs. books mismatches

-

Non-compliance with Section 206AB (higher TDS on non-filers)

This has resulted in a surge of:

-

CPC-TDS notices

-

E-verification emails

-

Automated mismatch alerts

-

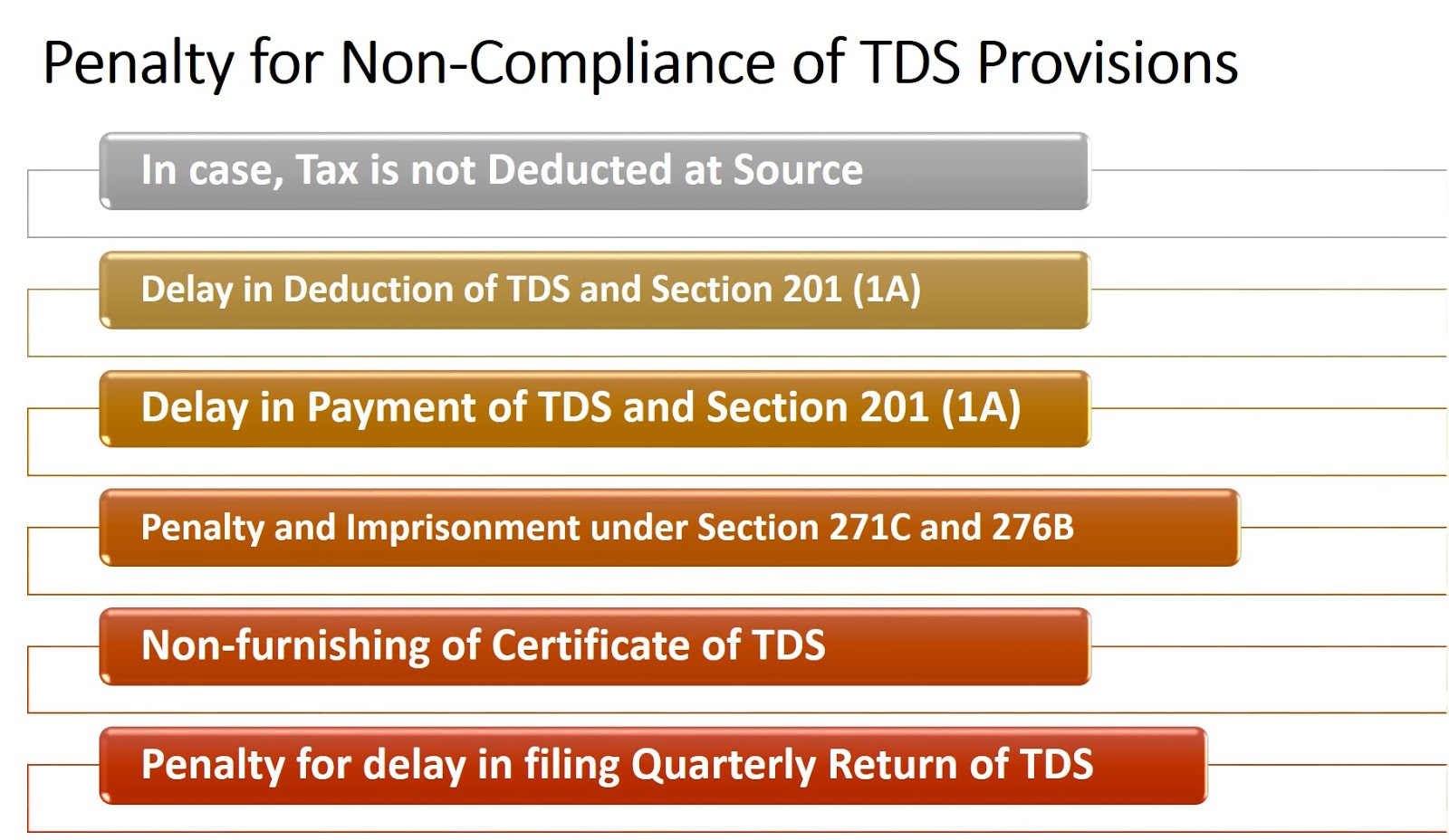

Penalty demands under Section 234E & 271C

Businesses across all states—Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, MP, Karnataka, Telangana, Rajasthan, West Bengal and Kerala—face similar challenges, irrespective of size or industry.

2. Comprehensive TDS Rates, Thresholds & Sections for FY 2024–25 (India-Wide Guide)

Core TDS Sections Applicable Across India

| Section | Nature of Payment | Threshold | Rate | Compliance Challenges |

|---|---|---|---|---|

| 192 | Salary | As per regime | Slab-based | Regime mismatch, proof validation errors |

| 194C | Contractor | ₹30k / ₹1 lakh | 1%/2% | Applies to labour, transport, logistics vendors |

| 194J | Professional Fees | ₹30k | 10% | Frequent misclassification with technical fees |

| 194I | Rent | ₹2.4 lakh | 2%/10% | Wrong segregation between furniture/plant |

| 194Q | Purchase of Goods | ₹50 lakh | 0.1% | Biggest source of defaults post-2021 |

| 194H | Commission | ₹15k | 5% | Applies to agents, incentive payouts, reseller schemes |

| 194IB | Rent by Individuals | ₹50k per month | 5% | Applicable for high-value rent cases |

| 206AB | High TDS on Non-Filers | — | Double rate OR 5% | Mandatory PAN + ITR verification |

The Most Common Mistake Across India

Businesses wrongly believe TDS applies only to large transactions.

In reality, TDS is triggered across day-to-day expenses, including:

-

Professional retainers

-

Digital marketing fees

-

IT services

-

Transport contractors

-

Security services

-

Co-working rent

-

Cloud service payments

-

Freelance payments

3. The New National Compliance Framework: Why AIS, TIS & 26AS Matching Is Mandatory

From FY 2023 onward, the Income Tax Department has implemented nationwide automated cross-matching between:

-

Your books of accounts

-

TDS returns filed (24Q, 26Q, 27Q)

-

Vendor filings

-

AIS / TIS system entries

-

Form 26AS

Businesses receive notices for issues like:

✔ TDS deducted but return not filed

✔ TDS filed but challan not matched

✔ Expense booked without TDS deduction

✔ TDS return filed under wrong section

✔ Salary TDS mismatch with employee proofs

✔ TDS deducted but not reflected in vendor 26AS

This is now data-driven scrutiny, applied uniformly across India.

4. Major TDS Errors Seen Across Indian Businesses (Based on Nationwide Observations)

Based on nationwide audits, the most common TDS errors include:

1. Applying Wrong Sections

Example: Treating technical services as professional fees.

2. Deduction after Payment (Late Deduction)

This triggers interest under 201(1A).

3. Misunderstanding Section 194Q

Purchase-of-goods TDS is now a high-risk audit item.

4. Not Checking Vendor Compliance (Section 206AB)

Businesses fail to deduct higher TDS from non-filers.

5. PAN Errors Leading to 20% TDS

Incorrect PAN triggers automatic defaults.

6. Non-Filing or Late Filing of TDS Returns

₹200/day late fee under 234E + penalties.

7. Salary TDS Errors Under Section 192

Incorrect regime selection or HRA/LTA mismatches are most common.

8. Incorrect Vendor Classification Nationwide

Such as:

-

Freelancers → Professional

-

Digital agencies → Technical/professional

-

Cloud services → Technical

-

Contract labour → Contractor

5. Why Businesses Across India Are Shifting to Expert-Managed TDS Compliance

The modern TDS ecosystem demands expertise beyond basic accounting.

Professional TDS Management Includes:

✔ Precise deduction through correct section selection

✔ Monthly monitoring of thresholds

✔ Automated challan preparation

✔ Timely filing of Form 24Q, 26Q & 27Q

✔ TRACES portal handling & correction

✔ AIS / 26AS reconciliation

✔ PAN & ITR compliance validation under 206AB

✔ Payroll-linked TDS optimisation

✔ TDS audit (Form 3CD Clause 34) preparation

✔ Representation for TDS notices, defaults & assessments

Businesses in all major cities now prefer outsourcing TDS to experienced CAs due to the high penalty risks and strict compliance schedules.

6. End-to-End TDS Services Offered Across India

1. TDS Advisory & Compliance Architecture

Strategic design of TDS systems for startups, MSMEs & corporates.

2. Monthly TDS Computation & Deposit

Ensuring zero interest liability.

3. Filing of All TDS Returns (24Q, 26Q, 27Q, 27EQ)

With validation, correction & compliance reporting.

4. Salary TDS & Payroll Structuring

Tax regime optimisation + proof verification.

5. Vendor Due Diligence (PAN Verification + 206AB Check)

Minimising improper deductions.

6. TRACES Portal Handling

Correction statements, defaults removal, challan mapping.

7. TDS Audit Support (Form 3CD Clause 34)

Complete documentation & reporting.

8. TDS Notice Assistance Across India

Representation for CPC-TDS, AO reviews & penalties.

7. Why Businesses Across India Prefer My Professional TDS Services

✔ Practising Chartered Accountant with strong command over Income Tax Act, GST, Accounting Standards & Auditing Standards

✔ Proven experience in handling complex TDS scenarios

✔ Software-driven reconciliation & automated compliance tracking

✔ National client base across manufacturing, trading, IT, services, e-commerce, logistics & more

✔ Transparent, consistent and timely deliverables

✔ Advisory approach instead of mere compliance

8. Final Insight: TDS Compliance in 2025 Is About Precision, Prediction & Prevention

India’s taxation system is rapidly evolving. With increased digitization, TDS has become a primary checkpoint for:

-

Expense allowance

-

Business transparency

-

Tax leakage detection

-

Audit assessment

-

Data-driven scrutiny

Businesses that adopt preventive TDS compliance today will stay penalty-proof, audit-ready and future-secure.

If your organisation—anywhere in India—wants compliant, accurate and risk-free TDS management, professional assistance is the simplest and safest path forward.

Nationwide TDS Support: Contact Details

📞 Call: 7999028234

📧 Email: pankajagrawal0116@gmail.com

🏢 Pankaj Agrawal & Associates, Chartered Accountants

Providing professional TDS, Accounting, Auditing, GST & Income Tax services to businesses across India.